By Jim Jensen 5-4-23

Authors note: Make sure you read our first blog on this topic over here.

The Dollar’s Demise

The United States is at a crossroads. With our economy failing, the dollar about to lose its global stature, and the technology available to seize total control, there is a very real risk that something extremely bad could happen. What happens when the organization with the most powerful military in the world goes bankrupt?

While the world watches the formation of BRICS and a host of countries lining up to dump the dollar, a conspiracy between the Federal Reserve and the federal government to shirk their fiduciary responsibility has ensured the dollar’s demise. It’s clear now that the life of the US dollar as the world reserve currency is coming to an end. Fun fact- did you know BRICS was decided on at the United Nations meeting in 2016, held in New York. The only question is what will come next?

The only reason the US has been able to deficit spend $31 trillion is because (mostly) China was banking on the good faith and credit of the US government. Even the most uninterested observer can see that we have no intention of ever making good on our debt. From the outside looking in, it appears as though the United States is making zero effort to reign in its reckless spending or curb its outrageous money printing. If China believes they are about to lose trillions, would they be justified in coming over to take repayment?

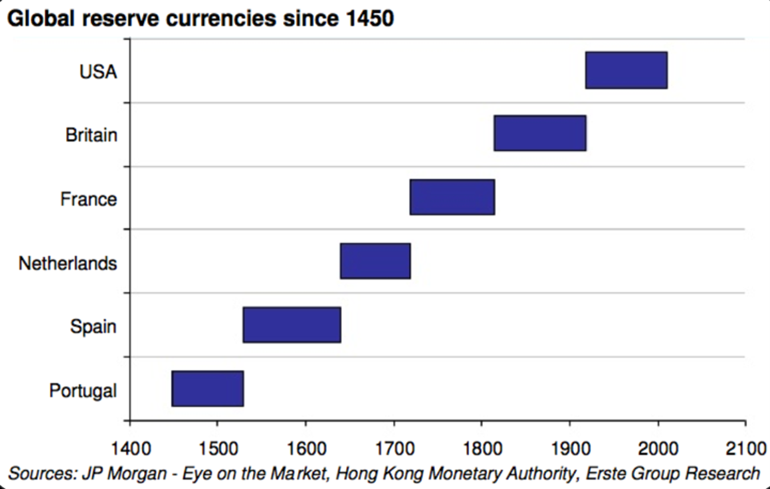

The last 600 years has shown that the lifespan of a global reserve currency is right around 100 years. The United States took the mantle right after World War I. Do the math. Our time is up. If most countries defect from the dollar as the reserve currency, the United States government may go bankrupt. If other countries are not willing to finance our spending addiction, we will be using the dollar for toilet paper.

Digital Currencies

As savvy investors look for safer alternatives, cryptocurrency is gaining traction. Digital assets like Bitcoin are based on blockchain technology. Blockchain uses cryptography to secure transactions making it extremely difficult or impossible to alter.

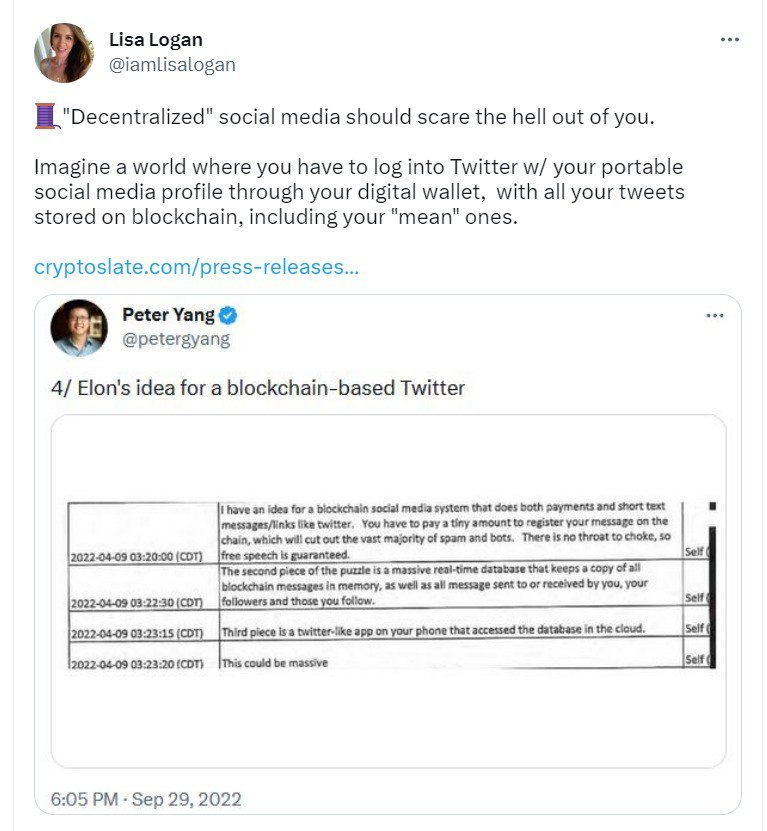

One reason blockchain is popular is because it’s based on an open, distributed ledger. That means that the databases are spread out on an open network that is decentralized. Because it is open, anyone (who is smart enough) can inspect all the transactions and no single entity has control over the system. This is bad news for shady transactions because they are impossible to hide. Imagine if politicians were required to host their financial transactions on an open, decentralized system while they were in office.

People are attracted to a decentralized network precisely because they don’t trust big government and big business to act in good faith. Sadly, the WEF and United Nations are BIG promoters of “decentralized” blockchain and more. There is always someone in control, who is it in this case? If you are still on the fence about whether digital currencies are good, note that a couple years ago the CCP made it illegal to produce, buy, or sell digital tokens in China. The fact that the totalitarian regime banned crypto is all you need to know to understand how important they can be to freedom if used properly. Instead, the Chinese government is in the process of piloting their own digital currency backed by the good faith and credit of their central bank, the People’s Bank of China.

Many governments worldwide are racing to get into the digital currency game, including the United States. Central bank digital currencies (CBDCs), like the one China is launching, take the public benefits of blockchain and invert them to gain control. Whereas with an open, decentralized network anyone can inspect all the transactions, in theory that sounds good. Question is this- do you want ANYONE inspecting your transactions? Could that be used incorrectly?

Now on a closed, centralized blockchain network the central bank will be the only entity with visibility and they will be able to monitor the transactions of everyone using their digital currency. Do either of these options sound secure, liberty minded, and free?

Governments want to control digital currency, they say, to prevent illegal transactions like money laundering. To look at banking transactions in the United States, the government (theoretically) must get a court order based on a reasonable suspicion that illegal activity has occurred. This makes illegal activity more difficult to monitor. However, this hurdle also protects innocent individuals from unwarranted intrusion into their privacy.

The Dangers of CBDCs

Senator Cruz from Texas understands this. For the last two years Cruz has introduced legislation to forbid the federal government or the Federal Reserve from making a central bank digital currency. In a press release dated March 2023, Cruz explains the need for the legislation, “Unlike decentralized digital currencies like Bitcoin, CBDCs are issued and backed by a government entity and transact on a centralized, permissioned blockchain. Not only would this CBDC model centralize Americans’ financial information, leaving it vulnerable to attack, it could be used as a direct surveillance tool into the private transactions of Americans.”

The thought of the federal government having visibility into every one of your transactions is mortifying. The obvious next step is a social credit score like the one that has been running for years in China. In a social credit system, you earn credit by behaving “responsibly,” and you are docked for crossing paths with the government’s wishes. For example, if the government decrees that eating beef causes climate change, buying a steak from the grocery store would deduct from your score.

Then the government could make it so that if you want to, let’s say, go on vacation, you cannot purchase a plane ticket unless your social credit score is above a specified level. This kind of control is already in place in China, so it’s not as far-fetched as you might think. We have seen reports of Chinese citizens being docked for jaywalking and being denied public transportation for publishing unflattering blog posts about the CCP.

Fortunately, with over 1,000 cryptocurrencies already in play, it appears that the Feds may be late to the party. With many companies from small web browsers to fintech giants, helping people turn their smartphones and computers into crypto wallets, it’s growing increasingly unlikely the Feds will be able to compete or shut down digital asset investments. That is, without doing something extremely illegal and unconstitutional.

FedNow is live currently- but what happens in July? Check out their announcement here.

Lest you believe that there is NOT a push for a UNIVERSAL monetary system here they are talking about exactly that.

“Universal Monetary Unit (UMU), symbolized as ANSI Character, Ü, is legally a money commodity, can transact in any legal tender settlement currency, and functions like a CBDC to enforce banking regulations and to protect the financial integrity of the international banking system.”

Next Steps

Utah, always narcissistically trying to be the “world leader” in something, is jumping onto the bandwagon. With three bills passed recently, the state government is trying to position itself as a player in the blockchain craze. Below we go over two, but you can read about the tyrannical digital ID bill HB470 here.

House Bill 0357 (2023), governing the registration of decentralized autonomous organizations (DAOs) was passed to make Utah more attractive to people looking for a home for their blockchain company. A DAO is the name for a decentralized group of engineers and entrepreneurs who don’t have an office or tangible product, like a crypto company. To navigate the legal landscape more conveniently, they must organize as a legal entity. There may be a conflict of interest here. Are there any politicians currently pushing a “decentrazlized” web3, blockchain company currently? Or voting on the blockchain, and the digital id? Did they have any say in this bill? Does this allow for the government to remove transparency by being unregulated for them? Just some questions- this could be good or bad. We want your thoughts on this.

Utah HB456 (2022) requires the State Division of Finance to contract with a third party to accept payments to participating government agencies in the form of digital assets. This is a double-edged sword. On the one hand it could be good for unbanked citizens who want to pay their taxes using a cryptocurrency. It may also be a way for the Utah government to hedge its bets against the collapse of the financial system. The risk is that the legislature could at any time amend this bill to restrict payments to a future CBDC.

Given the financial precipice the United States is dancing on, it’s good idea to start preparing and understanding what will come next. Learn the difference between alternatives that promote freedom and those that suck the life out of society. We should support policies like the bill Senator Cruz is sponsoring that ensure Americans retain some financial freedom. We should oppose those seeking to give more control to a corrupt bureaucracy that has demonstrated it will not rest until it has destroyed the U.S. economy and seized totalitarian control over the rotting remains.

This is a very tough subject to walk through. Please make sure you read and investigate all options and make the choice best for you. We by no means are giving financial advice, just giving you information.