By: Veronica Harper

Reading code can be an arduous task. A task that is neglected by the majority of folks. We always assume that someone else who is better equipped to read and understand will do it. We cannot continue to do this. Each of us has a responsibility to keep the state we live in free from unscrupulous dealings between those in power. We the people must engage our leaders and stand for those principles that align with the U.S. Constitution and the Utah State Constitution. We have these documents as a written statement about our natural born rights. They are in place to support those rights and operate under a free government by holding our elected officials accountable. We the people govern, and our elected representatives are supposed to represent the people. So, shouldn’t we be asking our legislators if the bills they are proposing and passing are constitutionally sound?

This series has been dealing specifically with special districts. The creation of them should be no different than any other bill/law/act. They should all be within constitutional law. We know special districts are written into our state constitution. Article XI, Section 7 to be specific. We also know, there are a number of areas in our state constitution that are designed to keep possible corruption out of our government structure. Let’s look at what our state constitution says and ask if special districts align with or fall outside the boundaries of the document.

ARTICLE VI LEGISLATIVE DEPARTMENT

SPECIAL PRIVILEGES FORBIDDEN

According to Article VI, Section 28,

The Legislature shall not delegate to any special commission, private corporation or association, any power to make, supervise or interfere with any municipal improvement, money, property or effects, whether held in trust or otherwise, to levy taxes, to select a capitol site, or to perform any municipal functions.

SOURCE: Article VI, Section 28

Special privileges are forbidden. As you read through the document, ask yourself, does this mean our current statutes regarding special districts are not in line with the state constitution? The writing is clear when it states that the legislature will not delegate to a private corporation the power to levy taxes. With the implementation of The Point and the proposed Utah City and the power they have to levy a tax on local residents via bonds, it would appear this is contrary to what is stated in our constitution.

We have large land developers coming in and creating special districts by way of our legislators, who are writing it into code. This is contrary to this part of our state constitution. Large land developers should NOT have the power to step outside the boundaries of our elected officials’ scope and not be accountable to the people. As a side note, our representatives have been slowly taking away the people’s right to referendum, piece by piece. This year they passed SB199, a terrible bill that makes it even harder for the People to be heard.

ARTICLE VI

Lending public credit and subscribing to stock or bonds forbidden — Exception.

Article VI, Section 29

Neither the State nor any county, city, town, school district, or other political subdivision of the State may lend its credit or, except as provided in Subsection (2), subscribe to stock or bonds in aid of any private individual or corporate enterprise or undertaking. (2) Except as otherwise provided by statute, the State or a public institution of post-secondary education may acquire an equity interest in a private business entity as consideration for the sale, license, or other transfer to the private business entity of intellectual property developed in whole or in part by the State or the public institution of post-secondary education and may hold or dispose of the equity interest.

SOURCE: Article VI, Section 29

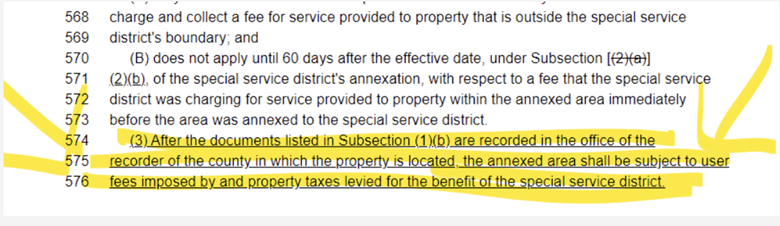

Why are things written in our proposed bills, as in the case of SB298, that clearly go against what is in our constitution? Subjecting taxpayers to additional fees that benefit the special service district should not be allowed to occur nor should it be written into any bills going before our legislative body. The state may not “lend its credit to developers in the form of bonds in aid of any private individual or corporate enterprise.” Luckily, this bill did not pass and for a very good reason. This is the reason for the public’s involvement. As another side note SB295 and SB228 (2023) did not pass either – but they plan on bringing these back in 2024.

Article XI, Section 7

Special service districts.

(1) | The Legislature may by statute authorize:

|

(2) | The authority to levy taxes upon the taxable property in a special service district and to issue bonds payable from taxes levied on the taxable property in the special service district shall be conditioned upon the assent of a majority of the qualified electors of the special service district voting in an election for this purpose to be held as provided by statute. |

(3) | A special service district created by a county may contain all or part of one or more cities or towns, but only with the consent of the governing authority of each city or town to be included in the special service district. |

SOURCE: Article XI, Section 7

The legislature is outside their boundaries in relation to Article XI, Section 7(1)(a). They may authorize a county, city, or town to establish a special service district, however, they (legislature) may not create code or statutes that allow outside entities to create their own special districts within a county, city, or town and who are not accountable to the people. The clause, “to be governed by the governing authority of the county, city or town” means just that. Special districts must remain in control of the local elected officials’ boundaries. This appears to be a blatant disregard for the municipalities in our state and a blatant disregard for our state constitution. To allow an outside entity all the benefits of a special district without any accountability by the people is a recipe for extreme abuse.

Please see video below from Governor Cox this year talking about not only taking away the city and counties ability to protect their community and actually represent their constituents, but also talks about taking away the right of the PEOPLE to dispute the brute force from the legislature of government overreach.

Section 1(c):

A land developer, who has created a special district, is able to issue bonds for their special district. This means they are able to tax the local residents above what they are already paying in taxes. Allowing a special district to be created within the boundaries of counties, cities, and towns and giving them taxing authority without being accountable to the people is against our constitution.

Land developers creating special districts for their projects, are able to tax without regard to the limitations in Article XIV, Section 4. This area of the constitution limits the amount of indebtedness cities, towns, and counties are authorized to be in. If land developers are their own quasi-government and not accountable to the people, they would be able to impose taxes beyond what the homeowner would potentially be able to afford, thereby placing the burden on the residents while the land developer bears little risk. It would also allow the land developer to enact eminent domain according to 17B-1-103 Special district status and powers.

Turning now to 17B-1-102 and portions of that code will be discussed that harm local residents and benefit land developers and compare it against the constitution. If you find any discrepancies, please leave a comment and our team will continue to research to find answers or, at the very least, generate more questions.

Effective 2/27/2023

17B-1-102. Definitions.

As used in this title:

(1) “Appointing authority” means the person or body authorized to make an appointment to the

board of trustees.

Whether bringing a board of trustee’s member on or filling a vacancy, the appointing authority appoints the person. Would this allow a land developer, who does not live in the area being developed, the opportunity to get appointed to sit on the board of trustees? Or does this allow the appointing authority to bring an applicant on who does not live within the boundaries? If so, how is this representative government?

The board of trustees may also “divide the special district, or the portion of the special district represented by appointed board members, into divisions so that some or all of the appointed members of the board of trustees may be appointed by division rather than at large.”

SOURCE: 17b-1-206.5(2) Dividing a special district into divisions

17B-1-201 Definitions. As used in this part:

(1) “Applicable area” means: (a) for a county, the unincorporated area of the county that is included within the proposed special district; or (b) for a municipality, the area of the municipality that is included within the proposed special district. (2) “Governing body” means: (a) for a county or municipality, the legislative body of the county or municipality; and (b) for a special district, the board of trustees of the special district.

The board of trustees’ members are appointed by the appointing authority. How is this representative government if they are not elected by the people?

(8) “General obligation bond”: (a) means a bond that is directly payable from and secured by ad valorem property taxes that are: (i) levied: (A) by the district that issues the bond; and (B) on taxable property within the district; and (ii) in excess of the ad valorem property taxes of the district for the current fiscal year; and (b) does not include: Utah Code Page 2 (i) a short-term bond; (ii) a tax and revenue anticipation bond; or (iii) a special assessment bond.

Is it clear that land developers who are able to create special districts within counties, cities, and towns, have taxing authority by virtue of the statute? This is clearly a violation of our constitution. The special districts should be governed by the city or county where the project is located. Local officials are powerless to enforce the code due to the land developers being able to create their own special district as well as Public Infrastructure Districts within the special district. Local residents would essentially be getting double taxed.

I wanted to give you some reading material to catch up on what is happening in Utah regarding housing/development. SB199 that we mentioned earlier, also contributes to this area as well. See if you think there are conflicts with our state constitution here.

SB34 Affordable Housing Amendments

Decent bills like this one from Rep. Birkeland to stop some of this madness were not passed.

This bill requires several % increases across various areas.

HB303 – Local Land Use Amendments

HB462 – Affordable Housing Amendments

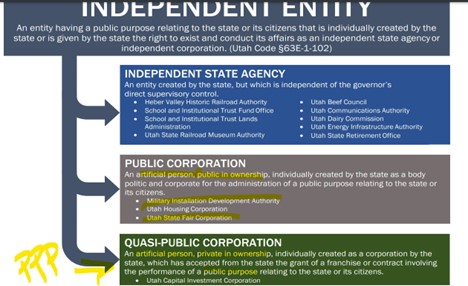

Utah Code, Title 63E-1-102 ties it all together.

This statute allowed for the following,

(7) | “Public corporation” means an artificial person, public in ownership, individually created by the state as a body politic and corporate for the administration of a public purpose relating to the state or its citizens. |

(8) | “Quasi-public corporation” means an artificial person, private in ownership, individually created as a corporation by the state, which has accepted from the state the grant of a franchise or contract involving the performance of a public purpose relating to the state or its citizens. |

SOURCE: Independent Entities Act

As you read and try to tie things together, please do not get discouraged. When you do, take a break, ask others to get involved and read so you can discuss with them the questions that are generated but please do not walk away. Even our team, who spends countless hours reading through code, are trying to decipher what is going on. The best thing is to ask questions and keep asking questions. Reach out to your elected officials, city, and county council members, and ask questions. Work with them to help get us back to basics and in line with our state constitution.

In closing, one last question should be asked. Do proposed bills go through a constitutional check prior to them being introduced on the house or senate floor? Or do the drafting attorneys create legalese language that is purposely confusing?

I would propose that a bill be created to ensure that a constitutional review of all proposed bills be conducted prior to being introduced on the house or senate floor. We need to get back to basics and bring our state back to its constitutional roots. We need to ask our local city and county councils as well as our legislatures to nullify these destructive public private partnerships and these corporations that come in and act as a quasi-government entity. Instead of shoving through 800 plus bills, give or take each session, why not start a massive “undoing?” Why not work on repealing/revoking bad bills and law? The freedom of our beautiful state is at stake, and we should stand up for our freedoms.